Investing that

Goes Beyond Capital

Investing that

Goes Beyond

Capital

Goes Beyond Capital

Goes Beyond

Capital

Our Approach

We believe support is more than just financial. Successful founders need investors and partners who can bring new value to the relationship. Geodesic facilitates, leads, and guides their journey into Japan and Asia.

With a foundation in Silicon Valley and a longstanding relationship with Japan, we’re positioned to find and fund leading tech companies and to be a conduit to assist them in the Japanese market, one that has long challenged many founders. By facilitating both high-level and mid-level relationships and providing expert counsel in Japan, we help them succeed in a market they know they have to win, but one that requires a fundamentally different approach.

Supporting Our Portfolio Companies

Supporting

Our Portfolio

Companies

To maximize portfolio success in Japan, Geodesic has a team of market experts and former country managers based in Tokyo. Geodesic Japan is a deeply experienced team of technology veterans using their collective expertise and network to support entrepreneurs in every key endeavor from hiring to selling to partnering.

Geodesic Japan builds go-to-market playbooks, provides sophisticated strategy input, helps recruit, interview, vet and hire key local talent, supports proofs of concept, establishes partnerships, builds customer pipelines, and navigates the intricate bureaucracies and decision-making processes inside Japan’s largest corporations, financial institutions, and government entities. In short, our Japan team shrinks the time it takes to succeed in Japan.

What Makes Us Different

01. Network

Our team of investment experts, along with our Japanese limited partners, and our relationships across Japan, make up a network that is second to none. We help build important connections for our companies in Japan with partners, customers, system integrators and others in the ecosystem necessary to expedite success.

02. Support

We are an experienced resource to help our companies evaluate and reference key hires, to introduce them to high-quality service providers to get the right office space, the right IT support and most importantly, to avoid common, costly mistakes.

03. Strategy

Our investments begin with financial infusion, but our impact comes from the strategic advice and tactical guidance we provide to our portfolio companies based on decades of experience leading tech companies in the Japanese market. We help our portfolio companies demystify cultural differences, deal effectively with corporate decision-making, understand Japanese business processes and navigate government bureaucracies.

Our Portfolio

We look for founders of transformative technologies who aim to win every market in the world and understand Japan is a critical step in the process. A focus on Japan isn’t a requirement for us to invest, but we believe that globally-minded companies will need to win the Japanese market at some point in their journey. We’re experienced and equipped to design and expedite their path to success in Japan, whether the time is now or down the road.

Our Portfolio

Insights & Perspectives

Insights &

Perspectives

Altruist: Transforming Wealth Management

Geodesic Capital is proud to introduce our newest portfolio company — Altruist! Altruist is revolutionizing wealth management with their vertically integrated platform that combines custody services with comprehensive technology tools at a fraction of traditional costs.

portfolio announcements

Test-Time Compute: Thinking, (Fast and) Slow

Discover how Test-Time Compute is revolutionizing AI by teaching models to “think before they speak,” upending the bigger-is-better paradigm and creating a new path for startups to compete with tech giants. Will Horyn breaks down this game-changing shift that’s behind the most impressive AI models of 2025, revealing why the future belongs to smarter—not just bigger—AI.

digital transformation

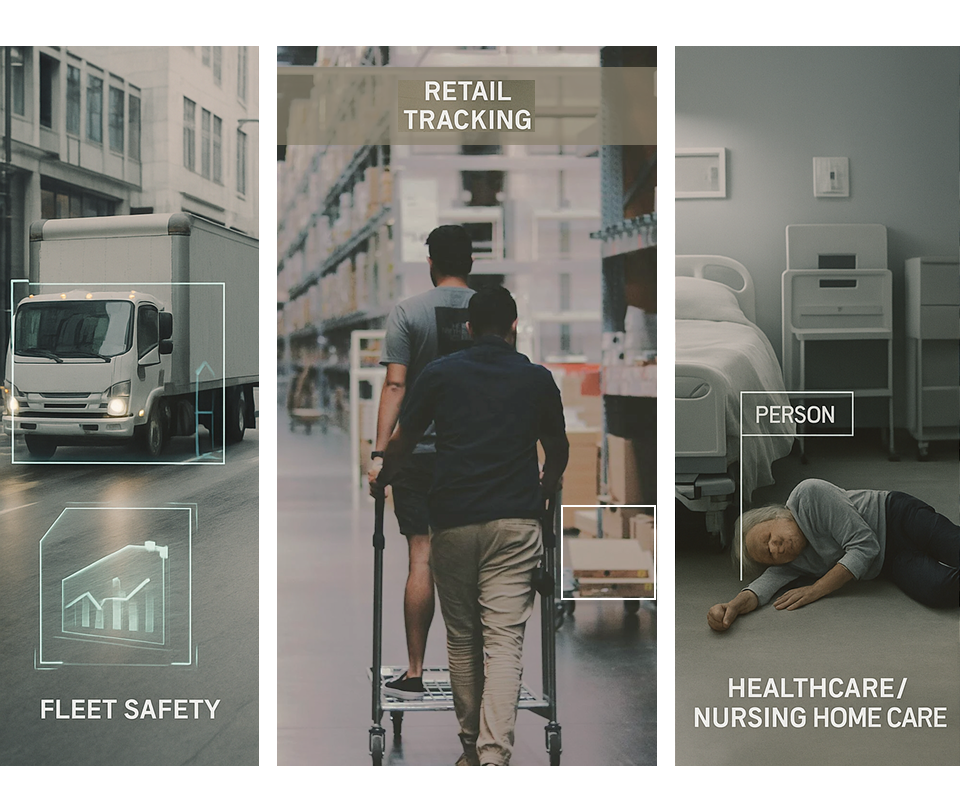

Video Surveillance in the Age of AI-Driven Intelligence

Divya Sudhakar explores the evolution of AI-powered video surveillance—from basic CCTV to cutting-edge predictive systems that are revolutionizing fleet safety, healthcare, and retail.

digital transformation